- Messy Action

- Posts

- Amy is a lot richer than she thought 💸

Amy is a lot richer than she thought 💸

Hey

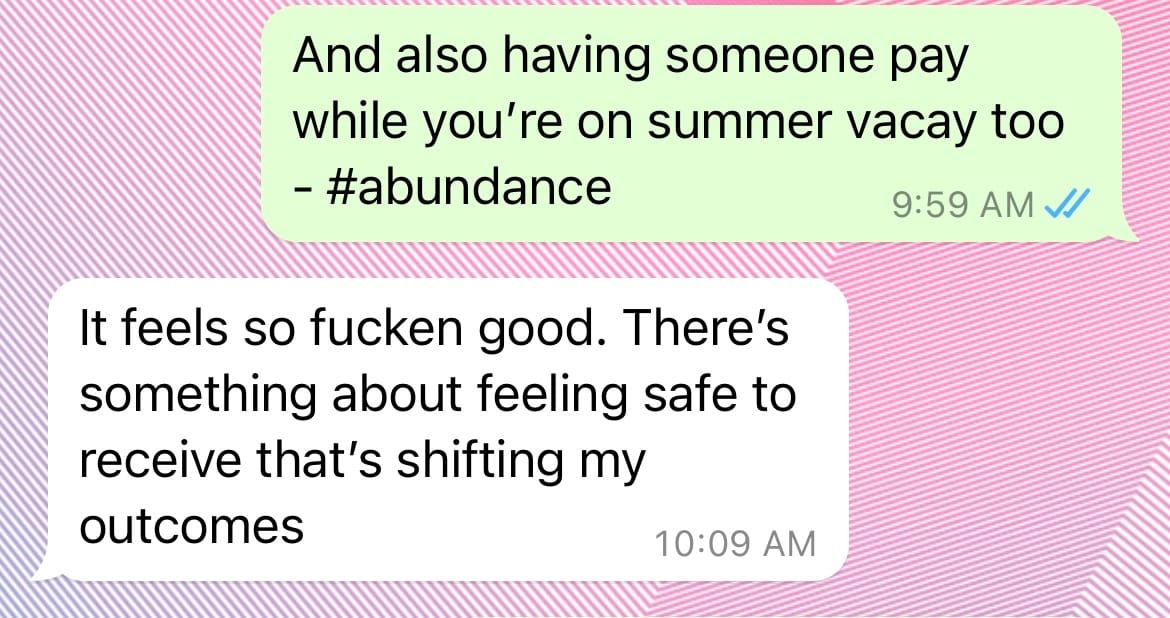

I was messaging a client, Amy, who’s in Messy Action Members Club this morning.

Our last club call was all about offers and expanding our capacity to receive.

In particular, our capacity to receive money, not just ‘value’ but actual cash.

Amy had mentioned that over the Christmas and New Year period she had secured someone to stay at their place at $365 per night over 4 nights which would have been $1,460 while they were on a family trip.

They’ve got another family coming in for an additional 5 nights at $1,600. In total it would have been $3,060 if one family hadn’t pulled out.

When Amy mentioned one family had pulled out, I said, “cool, this isn’t the end, let’s up the price and the intention, and create a timeline for it, let’s also say we’re available for x amount from know and unknown sources”

Something along the lines of “I am so grateful that an aligned renter has secured our family home for x dates at x price, thank you”.

She received this and was onboard with it.

Also, Amy and her husband invested $40,000 into building a small home on their beautiful lifestyle property. It’s now complete. Amy’s intention was to make more money from other sources outside of her business.

Amy also mentioned…

Mortgages cause a lot of stress for people and they really don’t have to. Amy is in a really great position and simply needed a change in perspective.

I am going to share how I responded so you have a breakdown and a play by play

We ended up getting a bit more specific so this is what we’re working with

$164,900 mortgage @ 5.8%

$25,000 bank loan for new build @ 6.2% for 2 years

$15,000 of personal cash invested

Total = $204,900 total.

$189,900 owing to the bank in mortgages and loans excl interest.

$15,000 to be paid back to self to recoup investment.

Let’s break it down

Amy and her husband have $189,900 owing to the bank total. $164,900 @ at 5.8% interest and $25,000 @ 6.2% interest. Their property is worth $1.4 million. Their mortgage is roughly 13.5% of the total property value. This means they OWN 86.5% of that property. This is leverage.

$15,000 of their personal cash was invested into the new property build on their land. It would take 34 weeks (less than 8 months) to make $15,300 back from the tenant renting this home at $450 per week.

$25,000 was borrowed from the bank as a personal loan for this build at 6.2% interest fixed for 2 years. 63 weeks of rent @ $450 per week = $28,350.

The tenant is paying $450 per week for their $40,000 investment. If the new small home is rented out for 52 weeks of the year, that’s $23,400 per year. In two years, they would have made $46,800 which is $6,800 more than the initial investment to build the house which would cover the interest (please note interest calcs are ballpark).

In two years, the initial investment is completely paid off by the tenant renting the property. Any extra cash that comes in weekly is residual income for Amy and her husband.

The mortgage for the main house right now is $164,900. If Amy and her husband wanted to be freehold in say, 4 years, without compromising on lifestyle choices aka not hustling and withholding and ‘going without’ - they could pay an estimate of $45,000 per year ($22,500 each if they were to split it) toward the mortgage and would be freehold in 4 years or less.

Once the new build is paid off, Amy will receive $23,400 per year from the tenant, meaning they’d only need to pay around $22,000 of their own money, toward the main house mortgage (give or take a few thousand depending on interest and lump sums).

As you can see, I am not an expert in the interest rates of mortgages but a bit of basic math has shown us that Amy and her husband are in a great position!

In 4 years or less when the entire property is paid off Amy and her husband have

Full ownership of a property worth $1.4 million +

An annual investment income of $23,400 per year that they don’t have to work for.

See how this is a huge perspective shift?

Yup…

🤗

Wanna expand your capacity to receive more?

Join us, Sunday, 12th November we kick off the 5-Day Money Maker Challenge - it’s all about the purge to re-emerge a more aligned, richer version of yourself.

Join us, 20% of all proceeds go to a charity we choose, together.

Who this challenge is for:

💵 You want to energetically upgrade the hell out of your standards, beliefs and money maker abilities.

💵 Those who want to let go of outdated beliefs and cycles they find themselves stuck in

💫 Spiritually minded folks that believe in a higher power

💸 Those who want to learn the energetic principals to attract, make, earn and receive more money

❣️ Those who crave to feel financially empowered, consistent and on top of their messy action commitments

✍🏼 Those willing to journal 40 minutes + per day throughout the challenge

Who is it not for:

😵💫 Folks not willing to let go of what they know they don’t want

💻 People that aren’t committed to the 5-Days (even if it ends up taking you 10 to complete, we don’t mind, we just want you to finish what you start so you get the results we promise)

😳 Skeptics and perfectionist avoiders

🤫 Those not willing to journal

NB: this is not specifically for business owners, this is for anyone that wants to positively overhaul their financial affairs.

We’ll see you, in our community, for our first kick off call

Forward this to a friend who may need it 💫

Here’s to…

Brooke’s website: https://brookenolly.com/